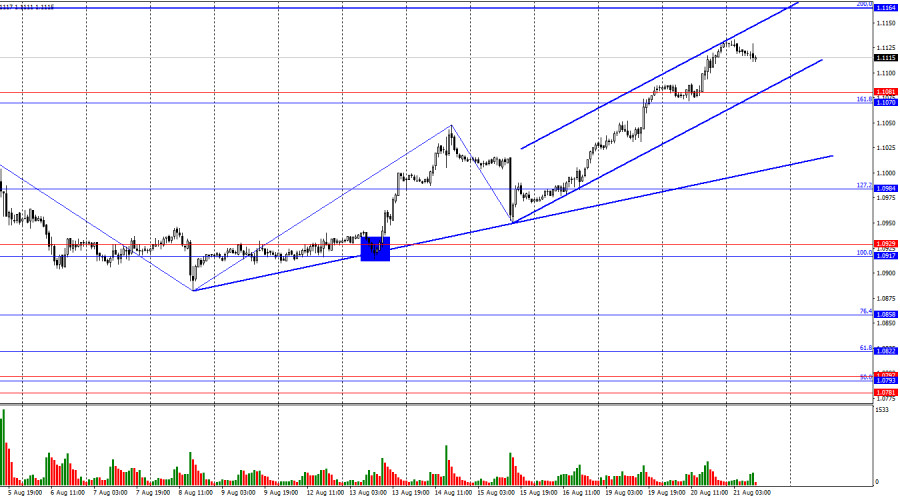

On Tuesday, the EUR/USD pair continued its upward movement after consolidating above the 1.1070–1.1081 zone. The upward movement in the pair's value continues on Wednesday within the upward trend channel, and the pair has a realistic chance of reaching the 200.0% corrective level at 1.1164 as early as today. The first signs of a retreat by the bulls will appear if the pair closes below the trend channel. The second sign will appear after a consolidation below the support zone of 1.1070–1.1081. However, even in this case, the growth of the U.S. dollar will be limited by the upward trendline.

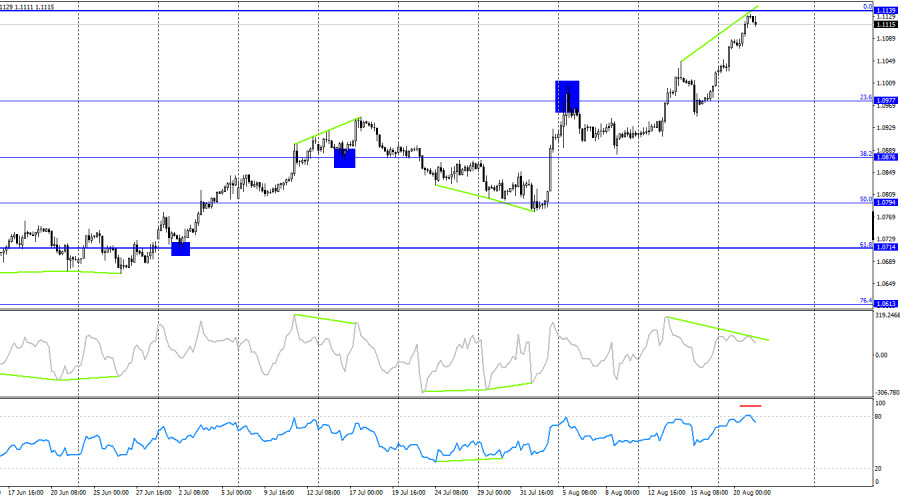

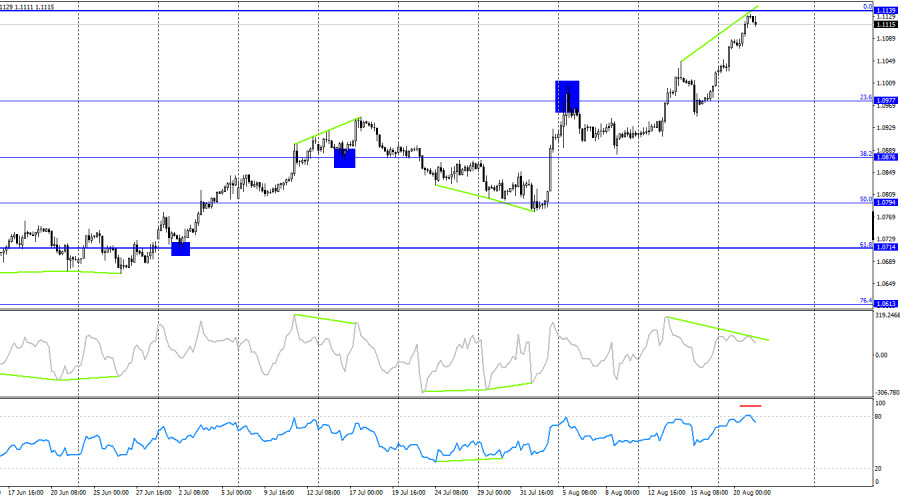

The wave structure has become a bit more complicated, but it remains clear overall. The last completed downward wave did not break the low of the previous wave, while the new upward wave has broken the peak from August 14. Thus, the "bullish" trend is still intact. For the "bullish" trend to be nullified, the bears now need to break the low of the last downward wave, which is near the 1.0950 level.

The news background on Tuesday was extremely weak, but this did not deter the bullish traders. Throughout the day, we saw steady euro purchases once again. I maintain my opinion that bullish traders continue to drive the market based on expectations of an FOMC rate cut and Jerome Powell's speech at the Jackson Hole symposium at the end of the week. Whether this is truly the reason or not remains an open question. However, I see no other reasons for such a strong decline in the U.S. dollar. I also don't find it logical, as traders have been offloading the dollar almost every day. The Fed will undoubtedly cut rates in September, but no one knows what will happen next. If inflation accelerates again in August, September, or October, will the Fed cut rates in November and December? In my view, the market is once again too optimistic and is getting ahead of itself. There aren't enough factors right now to justify selling the dollar every day.

On the 4-hour chart, the pair has risen to the 0.0% Fibonacci level at 1.1139. A rebound from this level could signal a reversal in favor of the U.S. dollar and a potential decline towards the 23.6% corrective level at 1.0977. The CCI has been signaling a "bearish" divergence for several days, and the RSI is in overbought territory. Thus, there are many factors indicating a potential decline in the pair by the end of the week. However, is strong growth in the dollar likely at this time? In my opinion, no. Even if a downward trend begins, it will take quite some time to gather the necessary confirmations.

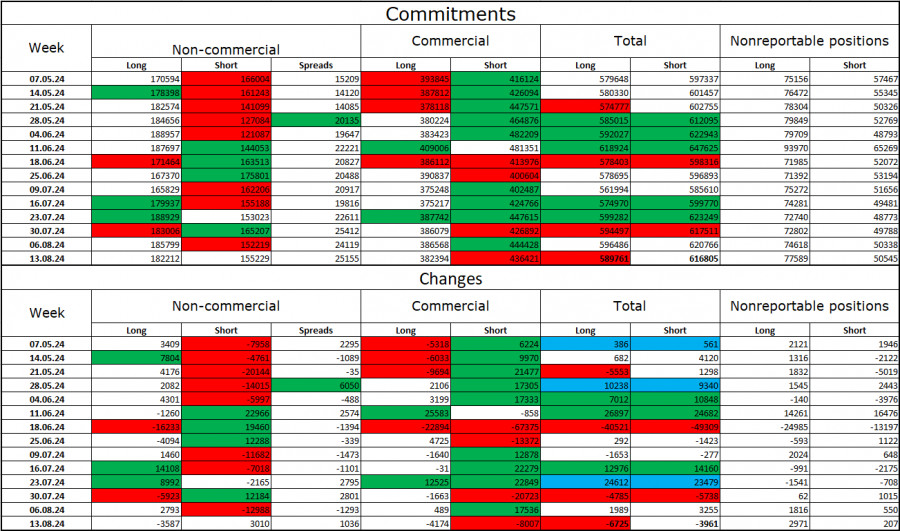

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 3,587 long positions and opened 3,010 short positions. The sentiment of the Non-commercial group turned bearish several months ago, but bulls are once again dominant. The total number of long positions held by speculators now stands at 182,000, while short positions total 155,000.

I still believe that the situation will continue to shift in favor of the bears. I don't see long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will lower the yields on bank deposits and government bonds. In the U.S., they will remain at high levels at least until September, making the dollar more attractive to investors. The potential for a decline in the euro appears significant. However, it is important to keep in mind the technical analysis, which currently does not strongly indicate a significant drop in the euro, as well as the news background, which consistently "throws a wrench" into the dollar's performance.

News Calendar for the U.S. and Eurozone:

U.S. – Release of FOMC Minutes (18:00 UTC).

On August 21, the economic calendar contains only one event. The influence of the news on trader sentiment today will be very weak.

Forecast for EUR/USD and Trading Advice:

Selling the pair today can be considered on a rebound from the 1.1139 level on the 4-hour chart with a target of 1.0977. Purchases were possible on a close above the 1.1080 level on the hourly chart with a target of 1.1140. This target is almost reached. I would approach new purchases with caution.

Fibonacci levels are plotted between 1.0917–1.0668 on the hourly chart and between 1.0450–1.1139 on the 4-hour chart.