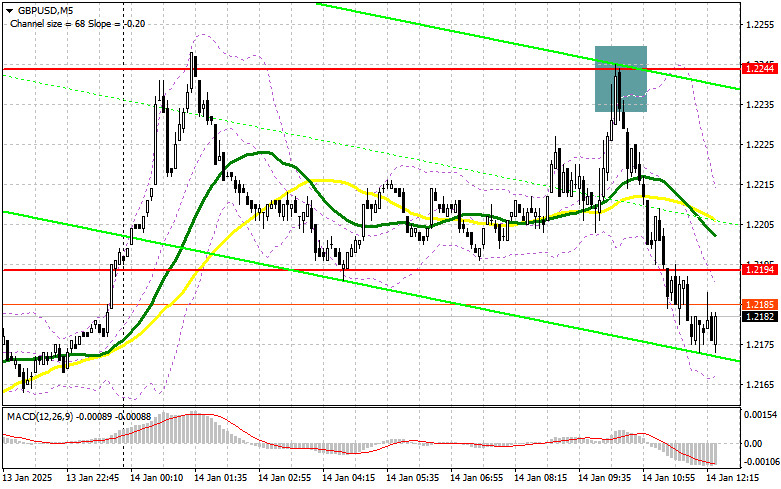

In my morning forecast, I focused on the 1.2244 level and planned trading decisions around it. Let's examine the 5-minute chart to see what occurred. A rise and subsequent false breakout at this range provided an excellent entry point for selling the pound, resulting in a drop of over 60 points. The technical picture remained unchanged for the second half of the day.

To Open Long Positions on GBP/USD:

The return of pressure on the pound is evident, and there is a lack of willingness to buy it at current levels following yesterday's correction. Strong US Producer Price Index (PPI) and Core PPI data, coupled with comments from FOMC members John Williams and Jeffrey Schmid advocating for more cautious rate cuts, are likely to boost confidence among dollar buyers, leading to another decline in GBP/USD.

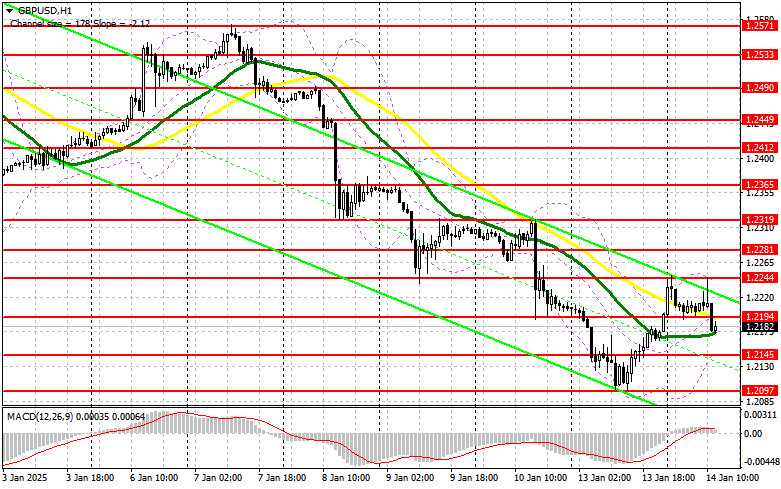

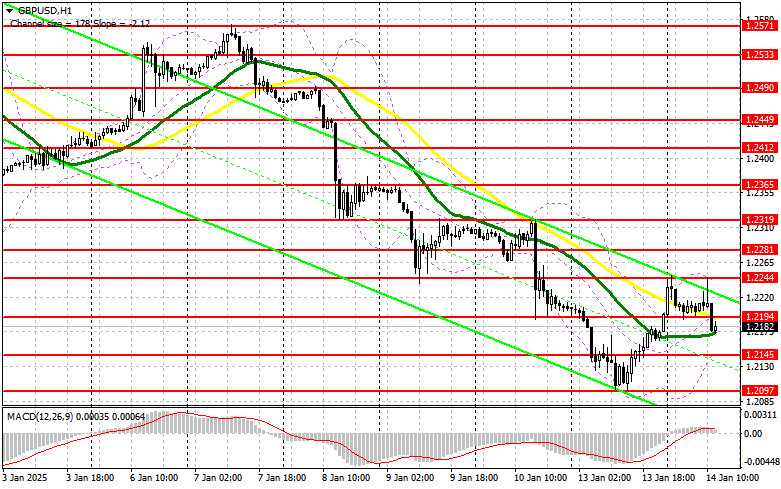

In the event of a decline, I plan to buy only after a false breakout forms near the nearest support at 1.2145. The target will be to restore GBP/USD to the resistance at 1.2194, which earlier served as support. A breakout and retest of this range from above would provide a new entry point for long positions, aiming for a retest of 1.2244, where we saw a strong decline earlier today. Buyers are likely to face more serious challenges there. The ultimate target will be the level of 1.2281, where I plan to lock in profits.

If GBP/USD declines further without any bullish activity near 1.2145, the pound could fall even lower. In this case, only a false breakout at the weekly low of 1.2097 would offer a suitable condition for opening long positions. Immediate buying on a rebound will be considered from 1.2065, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers have returned to the market—or perhaps never left. For the second half of the day, it's best to confirm bearish presence at the 1.2194 level. A false breakout there, following US data releases, would provide a good entry point for short positions, targeting further declines to 1.2145. A breakout and retest of this range from below would trigger stop-loss orders, paving the way for a drop to the monthly low of 1.2097, signaling further bearish market strengthening. The ultimate target will be the level of 1.2065, where I plan to lock in profits.

If demand for the pound returns in the second half of the day and bears fail to defend the 1.2194 level—where moving averages also favor sellers—short positions should be postponed until a test of the 1.2244 resistance. Short positions will be opened there only after a failed breakout, similar to the scenario outlined above. If there's no downward movement even there, I'll consider shorts on a rebound near 1.2281, aiming for a 30–35 point intraday correction.

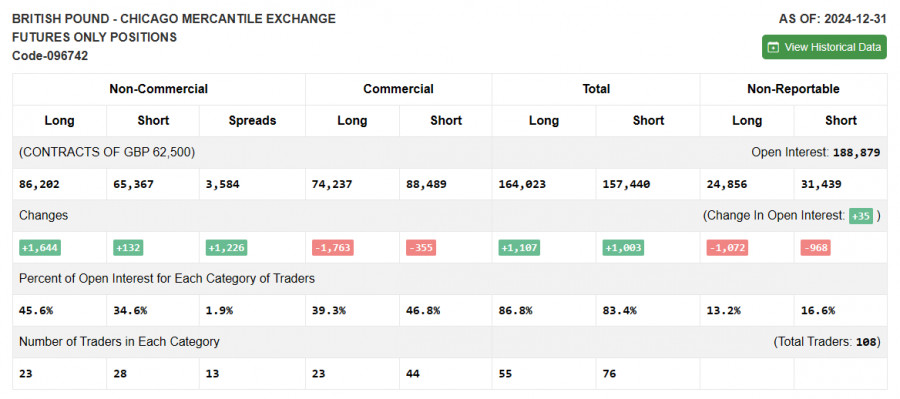

The Commitment of Traders (COT) report for December 31 showed an increase in both long and short positions. Overall, the balance of power remained unchanged, as many traders took a wait-and-see approach following the Bank of England's year-end meeting. The regulator's future position raises many questions, so attention is now likely to shift to Donald Trump's inauguration and his protectionist rhetoric. If Trump adopts a softer stance that doesn't include restrictive tariffs on the UK, the pound may regain its footing and strengthen. Otherwise, significant growth in GBP/USD is unlikely in the near term.

The latest COT report indicated that non-commercial long positions increased by 1,644 to 86,202, while short positions rose by 132 to 65,367. As a result, the gap between longs and shorts widened by 1,226.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30- and 50-day moving averages, indicating further declines for the pair.

Note: The moving average periods and prices analyzed by the author are based on the hourly H1 chart and differ from the classical daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.2145 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Periods: 50 (yellow on the chart) and 30 (green on the chart).

- MACD Indicator: (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-Commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific criteria.

- Non-Commercial Long Positions: The total long open positions held by non-commercial traders.

- Non-Commercial Short Positions: The total short open positions held by non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions held by non-commercial traders.