Analysis of GBP/USD 5M

GBP/USD traded within a range of about 30 pips throughout Tuesday. On the chart, this movement took place between the critical line and the 1.2701 level. Recall that 1.2691-1.2701 is an important area for the British currency. The price had stayed above this area for a long time, and it was this zone that prevented it from moving down. A few weeks ago, the price breached this area, but we did not see any drastic changes. The pound is still trading more sideways than downwards, but now it is below the 1.2691-1.2701 area.

Under current circumstances, breaking the descending trend line means absolutely nothing. The pound has no basis for a strong rise, and we don't expect it to rise in any case. Of course, the market may start buying the British currency without any justification, but we do not trade such movements, as there is no logic behind them. A logical move would be to fall further, but the market is not in a hurry to open short positions, so the downward move could be gradual. Especially this week, when the macroeconomic background is very weak, and the fundamental background is absent.

On Tuesday, there were no interesting events that could have influenced the pair's movement. Today the situation will be no better. Therefore, we may also see sideways movement on Wednesday.

No trading signals were formed yesterday, as the pair traded sideways all day. During the US trading session, it barely managed to stay below the critical line, but as we can see, the pair couldn't even fall by 15 pips.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent years. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and generally remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 8,100 buy contracts and closed 700 short ones. As a result, the net position of non-commercial traders increased by 8,800 contracts over the week, which is quite significant for the pound. Thus, sellers failed to seize the initiative at the most critical moment.

The fundamental background still does not provide a basis for long-term purchases of the pound sterling, and the currency has a good chance to resume the global downward trend. However, the price has already breached the trend line on the 24-hour timeframe at least twice. The level of 1.2765 is currently preventing the pound from rising further.

The non-commercial group currently has a total of 110,300 buy contracts and 58,200 sell contracts. The bulls have taken the initiative, but aside from the COT reports, there is nothing else that suggests a potential rise in the GBP/USD pair.

Analysis of GBP/USD 1H

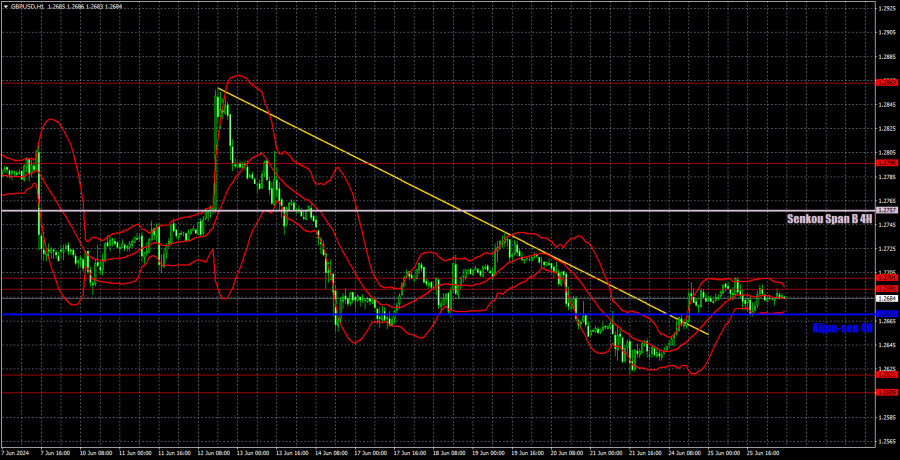

On the 1H chart, GBP/USD tried to start a new downward movement, but so far it looks as if it will end very quickly, as has happened numerous times before. The price has consolidated below the 1.2691-1.2701 area for the second time and has also bounced off this area from below. However, the bearish bias remains weak, and so does the overall volatility. The pound sterling is moving downwards again as if it's doing someone a favor, and it is still a big question whether it will manage to overcome the 1.2605-1.2620 area.

As of June 26, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2757) and Kijun-sen (1.2671) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

On Wednesday, there are no important events or reports scheduled in the UK and the US. We believe that traders should not expect strong movements today, and the price may attempt to return to the 1.2605-1.2620 area. It is unlikely that it will manage to move 70 pips in one direction in a single day, so we will most likely see an attempt to move towards the indicated area.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;